Bearish Candlestick Pattern

Table of Contents

Earlier we learnt about History Of Candlestick Chart & Some Most Popular Bullish Candlestick Pattern that signaling bulls taking control over bears. Bearish candlestick patterns indicates that leading uptrend is going to an end and reversal bearish pattern will start soon.

Bearish candlestick pattern is a single candle pattern or a combination of more than one candle pattern that signaling bullish trend going to reverse soon. Bearish candlestick pattern also known as bearish reversal pattern that hints that bulls getting weaker and bears taking control to reverse the market.

Candlesticks reflects everything that happens economically to politically. Each candle is a visual representation of buyers and sellers psychology and emotions. Below are some most popular Bearish candlestick pattern.

Best 8 Bearish Candlestick Patterns

- Hanging Man

- Gravestone Doji

- Shooting Star

- Bearish Engulfing

- Dark Cloud Cover

- Evening Star

- Three Black Crows

- Evening Doji Star

Hanging Man

Hanging man is a single candle bearish candlestick pattern having small body and long lower shadow. In this formation lower shadow must be twice compared to its body part. This is actually a bearish reversal pattern that comes after a strong leading bull trend. Hanging man is most commonly known candlestick pattern that act as a bearish reversal pattern from potential uptrend to downtrend.

As per the psychology of traders behind the candle formation is in the morning prices opens near the high of day but during the trading period sellers puss down the price lower. Finally at the end of the day bulls again takes control and managed their losses and price closes near the open price and forms a small body candle with long lower wick. This pattern helps traders to square of their long positions and open new short position for next day.

Hanging Man

Gravestone Doji

Gravestone doji is another single candle bearish candlestick pattern that indicates a trend reversal from leading uptrend to potential downtrend. A gravestone doji has open, low, and close at the bottom of the candle with no body and long upper shadow. It is a indecision to bearish candlestick pattern. This pattern’s bearish reversal success rate is 51% of the time and rest 49% of the time bullish continuation will happen. It is a rare pattern and occur less frequently.

Gravestone Doji

Shooting Star

Shooting start is a bearish candlestick pattern with success rate 59% of the time. This pattern occurs more frequently. This Bearish candlestick pattern shows the psychological behavior on which at the end of an uptrend prices attempted to new high but then bears pull the price down and closes near the open price that forms a small body (color not important) and long upper shadow and no lower shadow or very tiny lower shadow. Most of the time candle does not have lower shadow. The upper shadow must be at least twice the body height but some technical analyst says that shadow part must be three times.

After shooting star formation follow up candle will confirm bearish reversal because this pattern success rate is only 59%. Breakout occurs when the prices reaches above the high of shooting star or below the low of this candle. Tall upper shadow gives strong downside confirmation. After breakout confirmation a trader may enter in the breakout direction.

Shooting Star

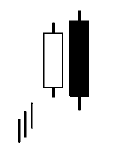

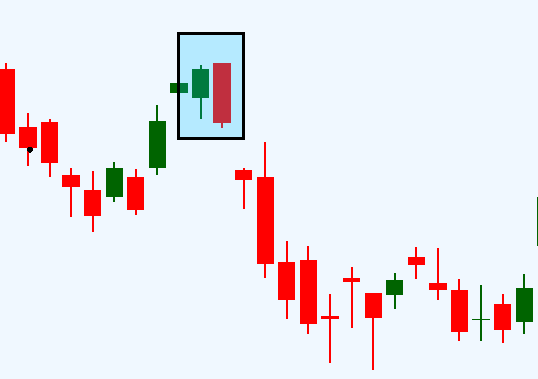

Bearish Engulfing

This is a combination of two candle bearish candlestick pattern. In this pattern current red or black candle fully engulf previous day green or white candle. Here engulfing means that current red candle’s open is above the previous day’s green candle’s close and current red candle’s close is below the previous day’s green candle’s open. This is one of the best bearish reversal pattern and its reversal rate is 79% of the time in bull market and 82% of the time in bear market.

This pattern’s occurrence is very frequent. In this two candle pattern first day candle will be green or white and second day candle will be black or red. This patterns takes two to four days for downward breakout and downward breakout (79% chances) takes about half the time compared to upward breakout(Chances 21%). In downward breakout it take between five to nine days for the price to end the trend. Tall Bearish engulfing perform best also candles with heavy breakout volumes perform best.

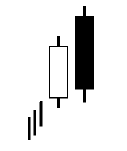

Dark Cloud Cover

This is another two candle bearish reversal candlestick pattern that comes after a leading uptrend and gives potential signal of trend reversal from uptrend to downtrend. In this pattern two candles appears, first candle is bullish green candle and second candle is bearish red candle. Dark cloud cover is just opposite to the bullish reversal pattern known as piercing line. In this two candle pattern the second candle opens above the high of first candle to make new high but at the end of the day closes at or below the midpoint of first candle’s body part.

This pattern’s success rate in bullish market is 60%. This perform best in bear market. After forming dark cloud cover pattern it takes less than a week for a price breakout in either direction (up or down). Candles with breakout below the 50 periods SMA or DMA will work better than breakout above the 50 period SMAL or DMA.

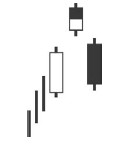

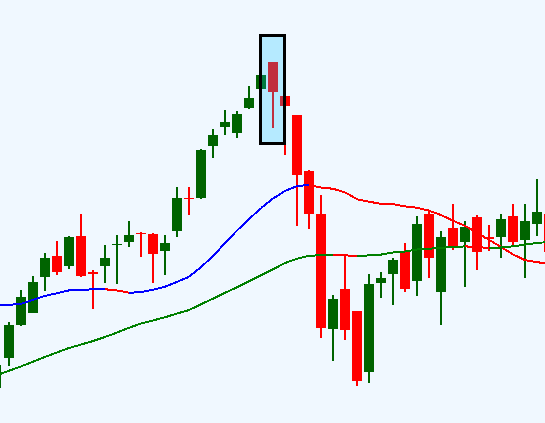

Evening Star

Evening star, theoretically it is a bearish reversal pattern but technically it is only 72% of time works as a strong reversal pattern but 28% of time it will not work as bearish reversal pattern. This is one of the best technical pattern amongst other patterns.

This is a three candle pattern in which first candle is bullish big green candle shows strong bulls control, next day gap up opening push price higher but small candle body shows that both bulls and bears fighting with each other to take control. Third day gap down and a big black candle shows bears in control. The third black candle must close at or below the mid point of first green candle body for strong confirmation.

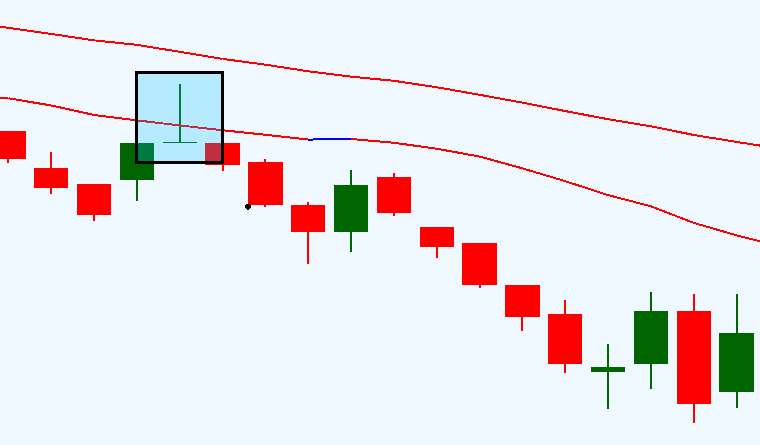

Three Black Crows

This is also a three candle strong bearish reversal pattern. Its reversal success rate is far better than evening star pattern. After making this pattern on chart 79% of the time a strong bearish reversal happen. In this pattern bulls have control an pushing price higher. Next a big red candle generates and after that another red candle and third day another red candle comes. Every red candle open where last red or bearish candle were closed. After three red bearish candle some bounce back comes then again start falling.

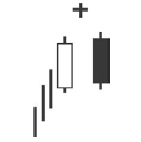

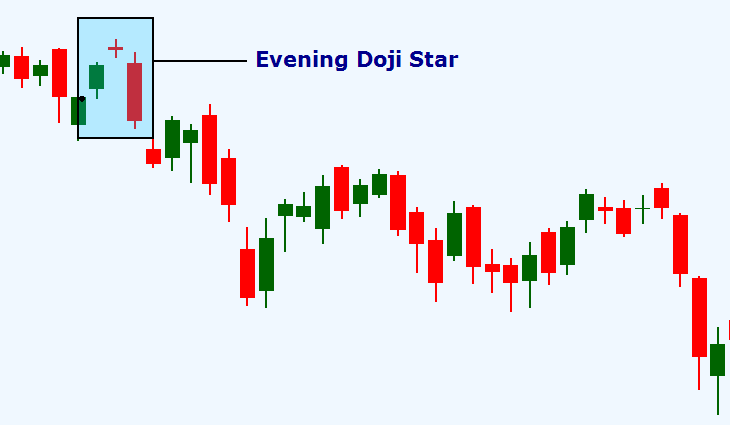

Evening Doji Star

This is three candle strong bearish reversal pattern with 71% success rate in both bull and bear market. Evening doji star sometimes called as southern cross, it is a rare candlestick pattern with very good performance. This candle pattern shown bullish to bearish reversal sentiments in three candle lines.

The first candle green bullish candle, second day more buying pressure and price gapup but bear try hard to pull the market down and then a small doji forms that means indecision. Third day bears take control and price gaps lower, forming a red candle that close well in or out of green candle. After pattern forming price goes more down. ” Doji is a candle in which opening and closing price same or almost same.”

This candle pattern takes three to seven days for the price to close either below the lowest price of pattern or above the highest price in the pattern. Downward breakout takes less time because price already near the low of the pattern.

Conclusion

We hope you’ll find this lesson a beneficial tool in your short-trading-strategy belt. Nothing beats the ability to read charts well and bearish candlestick patterns are an integral part to that process.